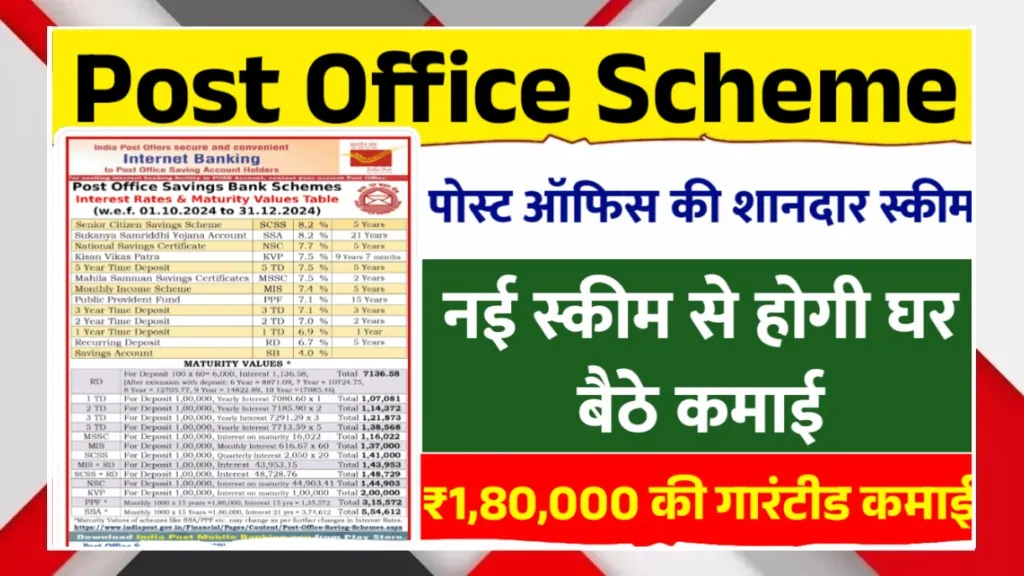

That’s why the Post Office Guaranteed Income Scheme really caught my attention. It is designed for people who want secure returns without worrying about market ups and downs. With disciplined investment and the right tenure, this scheme can offer up to ₹1,80,000 in guaranteed earnings. The best part is that it is backed by the Government of India, making it highly trustworthy. For students, young earners, and families, this scheme is a smart way to grow savings steadily while protecting hard-earned money.

Government Guarantee Ensures Complete Safety

One of the strongest reasons people trust Post Office schemes is the government guarantee. Unlike private investments or stock markets, your money here is fully protected by the Government of India. This means there is no risk of losing your principal amount. Even if the market crashes or the economy slows down, your investment remains safe. For young investors and middle-class families, this assurance brings peace of mind. You don’t need expert financial knowledge to invest, because the structure is simple and transparent. Safety makes this scheme ideal for long-term planning and secure wealth creation.

Fixed And Guaranteed Returns

This scheme is perfect for those who prefer fixed and predictable income. Once you invest, the returns are already decided and do not change with market conditions. With proper planning, investors can earn up to ₹1,80,000 as guaranteed income over the chosen period. This helps in managing future expenses like education, household needs, or small goals. For someone starting their financial journey at 21, guaranteed returns help build discipline and confidence. You always know how much you will receive and when, making financial planning much easier and stress-free.

Easy Investment Process For Everyone

Another great benefit of the Post Office scheme is its simple investment process. You can open an account by visiting your nearest post office with basic documents like Aadhaar and PAN card. The staff also guides you properly, which helps first-time investors. There is no complex paperwork or online confusion. Even people from rural areas can invest easily. For young people who are new to saving, this simplicity is a big advantage. It encourages regular saving habits without technical hurdles or hidden conditions.

Suitable For Long-Term Financial Goals

This scheme is ideal for long-term goals such as building a savings fund, supporting family needs, or planning future expenses. Since returns are guaranteed, you can rely on this investment without fear. Many families use it to secure a steady income source. For a 21-year-old, starting early means enjoying better financial stability later in life. Long-term investing also helps develop patience and smart money habits. Over time, small contributions can turn into a meaningful amount with zero risk involved.

Perfect For Risk-Averse Investors

Not everyone is comfortable with market risks, and that’s completely fine. This Post Office scheme is designed especially for risk-averse investors who value security over high-risk profits. It is suitable for students, salaried individuals, and senior family members alike. You don’t have to track markets daily or worry about losses. For young investors, it offers a safe foundation before exploring advanced investment options. This balance of safety and decent returns makes the scheme a reliable choice for steady and guaranteed income.