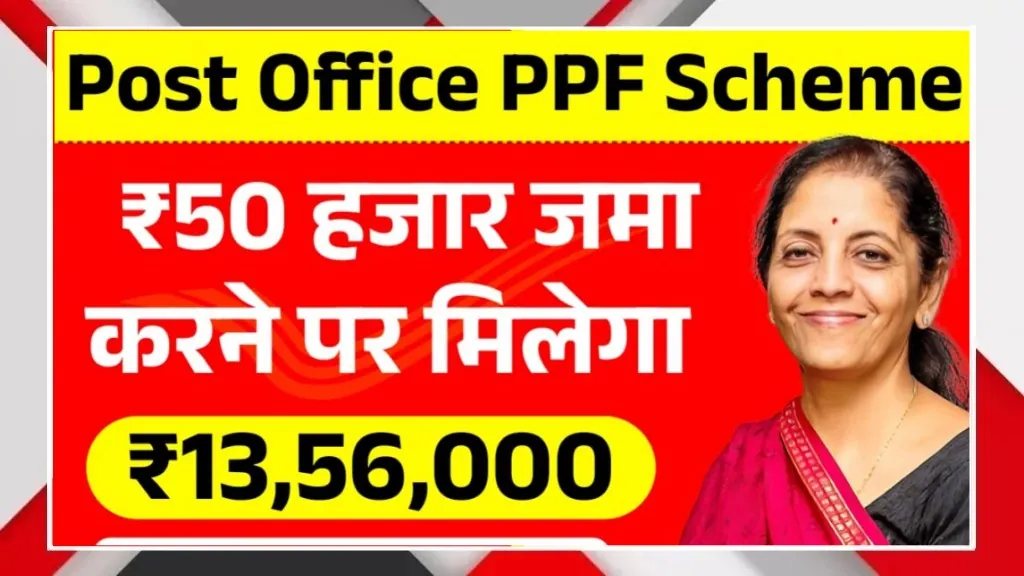

The Post Office PPF Scheme is a smart and safe investment choice for young people who want long-term financial security. As a 21-year-old, starting early in PPF feels like a responsible step toward a stable future. By investing ₹50,000 every year, you slowly build a strong fund without financial pressure. This scheme is backed by the Government of India, so the risk is almost zero. It is perfect for students, salaried youth, and first-time investors who want disciplined savings, tax benefits, and guaranteed returns over time.

How PPF Helps Build Long-Term Wealth

PPF is designed for long-term wealth creation, making it ideal for young investors. When you invest ₹50,000 annually, your money benefits from compound interest over 15 years. The longer your money stays invested, the more powerful the growth becomes. This habit teaches financial discipline at an early age. Even small, regular investments turn into a large maturity amount. For someone aged 21, PPF can act as a foundation for future goals like higher studies, marriage, or starting a business.

Guaranteed Returns With Government Safety

One of the biggest advantages of the Post Office PPF Scheme is safety. Since it is fully backed by the government, your money is secure regardless of market conditions. Unlike shares or mutual funds, PPF does not depend on ups and downs. This makes it stress-free for young investors who are new to saving. You can focus on your career while your investment grows steadily. This guaranteed nature builds confidence and trust in long-term financial planning.

Tax Benefits Make PPF More Attractive

PPF offers excellent tax benefits under Section 80C, which is a big plus for future taxpayers. The amount you invest, the interest you earn, and the maturity amount are all tax-free. This triple tax benefit is rare and valuable. For a young person, this means higher effective returns without worrying about deductions later. Over time, these tax savings significantly increase the real value of your investment and help you plan smarter.

Flexible Investment Options For Young Earners

PPF allows flexibility in investment amounts, making it suitable for beginners. You can start with a smaller amount and gradually increase it as your income grows. Deposits can be made yearly or in installments, which helps manage expenses. This flexibility is helpful for students or fresh job holders. Even with ₹50,000 per year, the burden feels light, while the long-term reward is impressive and motivating.

₹13,56,000 Maturity Builds Financial Confidence

By consistently depositing ₹50,000 every year, the maturity amount can reach around ₹13,56,000. This lump sum can support major life goals without taking loans. For a 21-year-old, this creates financial confidence and independence early in life. It also encourages better money habits and long-term thinking. PPF is not just a scheme, it is a disciplined journey toward a secure and stress-free financial future.