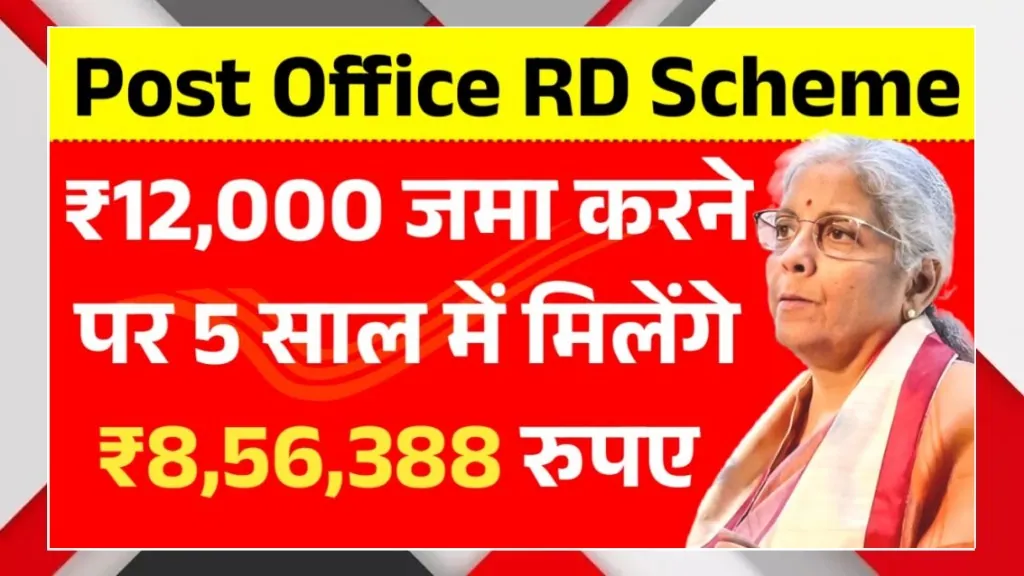

The Post Office Recurring Deposit Scheme is a smart savings option for a 21-year-old who wants safe and guaranteed returns. By depositing ₹12,000 every month for five years, your total investment becomes ₹7.20 lakh, and you can get around ₹8,56,388 at maturity. This scheme is backed by the Government of India, so there is no risk involved. It helps build a strong saving habit with fixed monthly deposits and compound interest. For students, fresh job holders, and young earners, this RD scheme is ideal for planning future goals like higher studies, business, or personal milestones.

Government-Backed And Completely Safe Investment

The biggest benefit of the Post Office RD Scheme is safety. Since it is supported by the Government of India, your money is fully secure. There is no impact of market ups and downs, so even risk-averse investors can invest confidently. For young people who are just starting their financial journey, this scheme provides peace of mind along with assured returns.

Monthly Deposit Of ₹12,000 Builds Strong Discipline

Saving ₹12,000 every month may look small, but over time it creates a huge fund. This fixed monthly investment helps develop financial discipline at a young age. Without feeling pressure, you slowly build a large amount that can support major life goals after five years.

Power Of Compounding Increases Returns

The interest in Post Office RD is compounded, which means you earn interest on both your deposit and previous interest. Because of compounding, your total investment of ₹7.20 lakh can grow to about ₹8.56 lakh in five years. This makes RD much better than keeping money idle in a savings account.

Easy Account Opening With Minimum Documents

Opening a Post Office RD account is very simple. You only need basic documents like Aadhaar card and PAN card. The account can be opened individually or jointly, and even minors above 10 years can have their own RD account. Almost every area has a post office, making it easily accessible.

Perfect For Short-Term Financial Goals

A five-year tenure is ideal for short- and medium-term planning. Since the maturity amount is fixed, you can plan your future expenses in advance. Whether it is education, starting a small business, or personal savings, this RD scheme helps young investors achieve goals without financial stress.