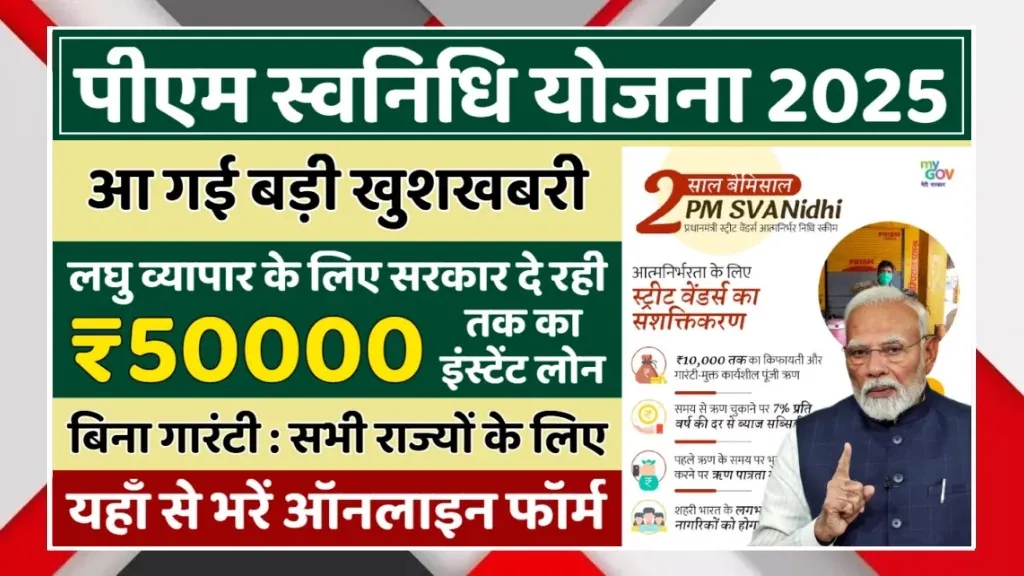

The PM SVANidhi Yojana 2025 is a major relief for small traders, street vendors, and self-employed individuals across India. Under this government-backed scheme, eligible beneficiaries can get an instant loan of up to ₹50,000 without providing any collateral or guarantee. The scheme aims to strengthen small businesses by offering easy credit, low interest rates, and flexible repayment options. Applicants who repay their loans on time also become eligible for higher loan amounts in the next cycle. The entire application process is online, making it simple and accessible even for first-time borrowers from economically weaker sections.

Instant Loan Up To ₹50,000 Without Guarantee

One of the biggest highlights of PM SVANidhi Yojana 2025 is that beneficiaries can receive loans up to ₹50,000 without any collateral. Initially, vendors can avail a loan of ₹10,000 to restart or expand their business. After timely repayment, they become eligible for a second loan of ₹20,000 and later a third loan of ₹50,000. This step-by-step loan structure helps build financial discipline and credit history. Since no security is required, even very small traders feel confident applying. This feature makes the scheme extremely beneficial for people who otherwise cannot access formal banking loans.

Eligibility For Small Traders And Street Vendors

The scheme is specially designed for street vendors, hawkers, cart pullers, and small shop owners operating in urban and semi-urban areas. Applicants must be engaged in vending or small trade activities and should be identified by local bodies or municipal surveys. Even vendors without formal registration can apply if they have a Letter of Recommendation from the local authority. This inclusive eligibility ensures that maximum people benefit from the scheme. PM SVANidhi Yojana is open for all states and union territories, making it a nationwide support system for small livelihoods.

Easy Online Application Process

PM SVANidhi Yojana 2025 offers a completely online application process, saving time and effort. Applicants can submit their details, upload documents, and track loan status digitally. The process is user-friendly and designed for people with basic smartphone knowledge. Banks and lending institutions verify applications quickly, ensuring fast loan approval. This digital approach reduces dependency on agents and minimizes chances of fraud. Overall, the online system makes the scheme transparent, efficient, and accessible to millions of small traders across the country.

Low Interest Rates And Timely Repayment Benefits

Loans under PM SVANidhi Yojana come with affordable interest rates compared to private lenders. Additionally, beneficiaries who repay their EMIs on time are eligible for interest subsidy credited directly to their bank accounts. Timely repayment also unlocks higher loan amounts in future cycles. This encourages responsible borrowing while improving the borrower’s credit score. Over time, beneficiaries gain trust from financial institutions, opening doors to other formal financial services. This feature not only provides money but also promotes long-term financial stability.

Boost To Self-Employment And Small Businesses

PM SVANidhi Yojana 2025 plays a crucial role in strengthening self-employment and micro-businesses. The loan amount helps vendors purchase raw materials, improve stalls, or expand operations. With better cash flow, traders can increase daily income and support their families more comfortably. The scheme also promotes digital transactions, helping vendors adapt to modern payment systems. Overall, PM SVANidhi Yojana is more than a loan scheme—it is a powerful initiative to empower small traders and support India’s grassroots economy.